The ultimate peace of mind for everyone involved.

Do you need a probate bond?

Probate is the legal process to administer a deceased individual’s estate. Probate bonds are a type of fiduciary bond often required by a court, or due to a stipulation in a will, to guarantee a fiduciary will perform their duties faithfully and honestly.

What do probate bonds cover?

A fiduciary is a person appointed by the court to be responsible for the affairs of a person that is not able to do so themselves. A probate bond guarantees the fiduciary will comply with state and local statutes as well as any terms outlined in a will or trust. If the fiduciary fails to perform his/her duties, a claim can be made on the bond.

Probate bonds protect beneficiaries by offering a financial guarantee that estates and assets are properly managed and distributed by the fiduciary. The following are several examples of tasks that a probate bond ensures will be performed lawfully and ethically:

- Filing a will.

- Contacting beneficiaries.

- Appraising value of estate and assets.

- Paying debts still owed by the deceased.

- Locating and paying inheritances to beneficiaries.

A fiduciary who is appointed to probate the estate is most often designated an administrator, executor, or personal representative. Our agency is licensed in all 50 states and Washington D.C. and is here to assist you with obtaining a probate bond.

Probate Bonds for Allegheny County, Pennsylvania

Allegheny County probate bonds are filed with the county’s Department of Court Records in the Wills/Orphans’ Court Division.

The county will require a probate bond in the amount of 125% of the value of the estate. The court will also determine if the value of any real estate must be included. To open an estate with the court, the minimum bond requirement is $8,000. Please confirm the bond amount the court will require prior to submitting a bond application, to avoid any delays or rejections with your bond filing.

After a bond is approved and payment is received, arrangements may be made for a bond team member from our office to meet the attorney and/or client at the Department of Court Records for the execution of the bond as almost always personal appearance by the bond team member is required by the county. For a meeting at the Department of Court Records’ office, a non-refundable $50 appearance fee shall be added to all Allegheny County Probate Bonds.

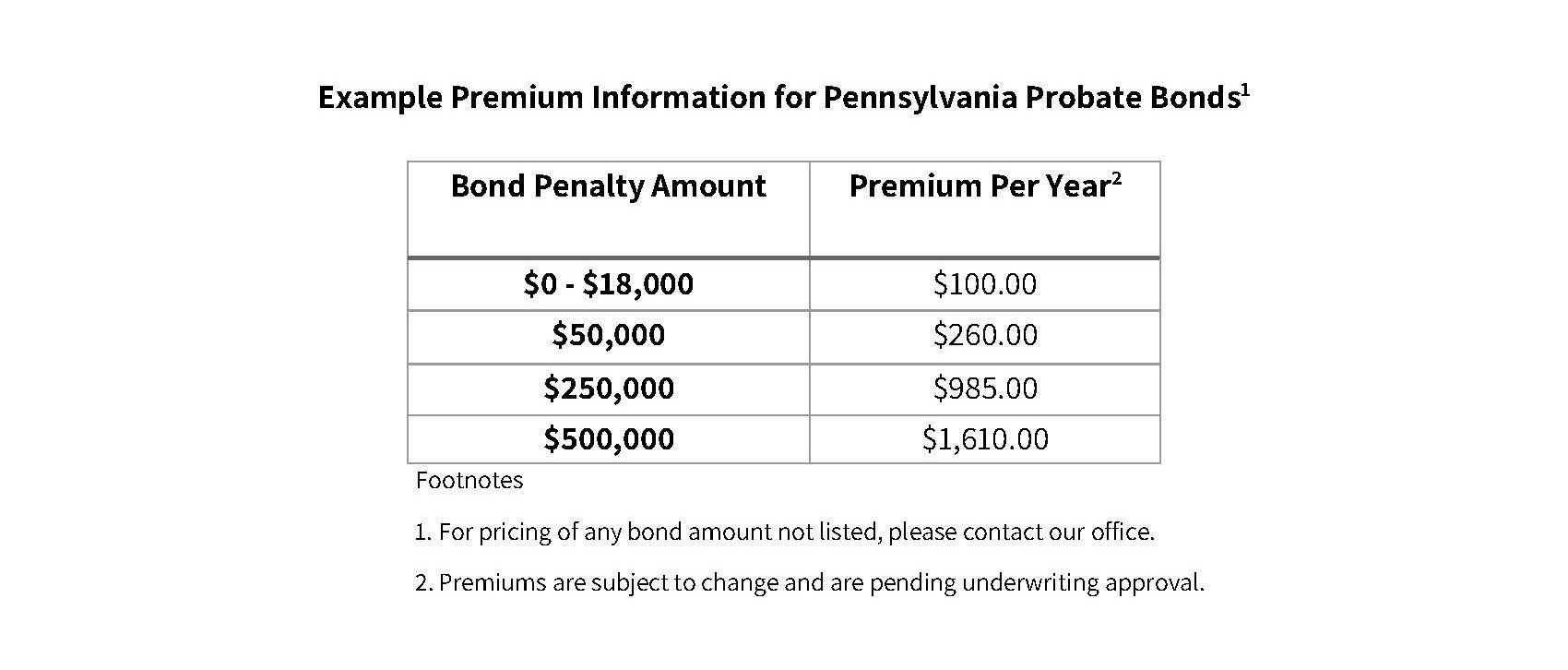

Example Premium Information for Pennsylvania Probate Bonds1

Probate Bond Application

Please download the probate bond application from our bond application page below. If the answer to any of the questions numbered 1-8 on page one is “Yes,” please also download and submit a completed supplemental probate application.

Call 877-376-8676 (877-ERMUNRO) to speak with a bond team member or email us at [email protected]. You can fax your applicatoin to 412-281-6195.

What is the difference between an administrator and an executor?

An administrator is a fiduciary appointed by the state when an individual has died without a will (intestate). An executor is a fiduciary named in a decedent’s will to probate their estate.

I obtained a probate bond from your agency but more assets have been found and I need to increase my bond amount. What do I need to do?

Each court will have their own requirements, but we can issue an additional bond to increase your total bond amount or issue a change rider (endorsement) increasing the amount of your original bond. Depending on the size of the bond increase, additional underwriting approval may apply.

We will also likely need a copy of the estate’s inventory that is mandating the bond increase and confirmation your attorney is still involved with the case. Please contact our office to confirm the specific information we will need to assist you with increasing your bond.

What is the fiduciary responsible for in a probate case?

A fiduciary has many duties to settle a decedent’s estate, including but not limited to assuming responsibility for the decedent’s property, paying any taxes or debts the decedent owes, collecting payments due to the estate, preserving the estate assets, distributing the estate assets to any heirs, and providing an accounting of all expenses to the court.

The estate has been closed by the court. What do I need to do to cancel the bond?

If your bond penalty is less than $250,000, please contact us to request cancellation. If your bond penalty is $250,000 or higher, we will need a final accounting for the estate, a discharge notice from the court, and a copy of the verification of closing evidence from the court’s online system. If you have additional questions, please contact us.

Can I get a refund for the probate bond once the estate is closed by the court?

Once a probate bond is issued and filed with the court, the premium is fully earned and a refund is not available in the first one-year term. If your probate bond amount is higher than $50,000, and the estate needs to remain open for more than one year, you will receive a renewal bill for a new term. If the renewal premium is paid and the estate is closed at any time after the first one-year term, the premium is pro-rated and a refund may be available to you.

What probate bond amount do I need?

The bond penalty, or value of the bond, is typically mandated by the court and is based on the value of the estate. Local and state statutes may also require a fiduciary to file a bond larger than the value of the estate.

As stated above, in Allegheny County, Pennsylvania, the bond amount must be for 125% of the value of the estate. Exceptions can be made for real estate or if an ongoing business will be involved. It is best to confirm with the court what bond amount you need to file.

How much does a probate bond cost?

The premium charged for a bond can vary depending on your bond amount and the state in which you are located. The higher the bond amount, the higher the premium. The minimum premium charged for any bond is $100. To give you a better idea, a $100,000 probate bond in Pennsylvania would cost $460, while a $750,000 bond would cost approximately $1,860. To obtain a quote for a bond in your state, please contact our office.

How long will it take to obtain a probate bond?

Upon receipt of a completed and signed application, a bond can be issued within 1-2 business days, pending underwriting approval.

Why does an attorney need to be involved?

The probate court has many statutes that a fiduciary must comply with. To navigate the court system, complete the steps necessary to settle an estate, and guarantee compliance with any local stipulations, we require an attorney to be involved for our probate bonds.

Get Started Today

As an independent agency, we are here to help you find the right Probate Bonds.

Probate Bonds Information Request

As an independent agency, we are here to help you find the right solution.

Request Information

It only takes a minute to get started.

- Fill out the form, we’ll be in touch.

- Review options with a bond team member.

- Get the coverage you need.