In an era where technology touches almost every aspect of our lives, it should come as no surprise that the…

In an era where technology touches almost every aspect of our lives, it should come as no surprise that the…

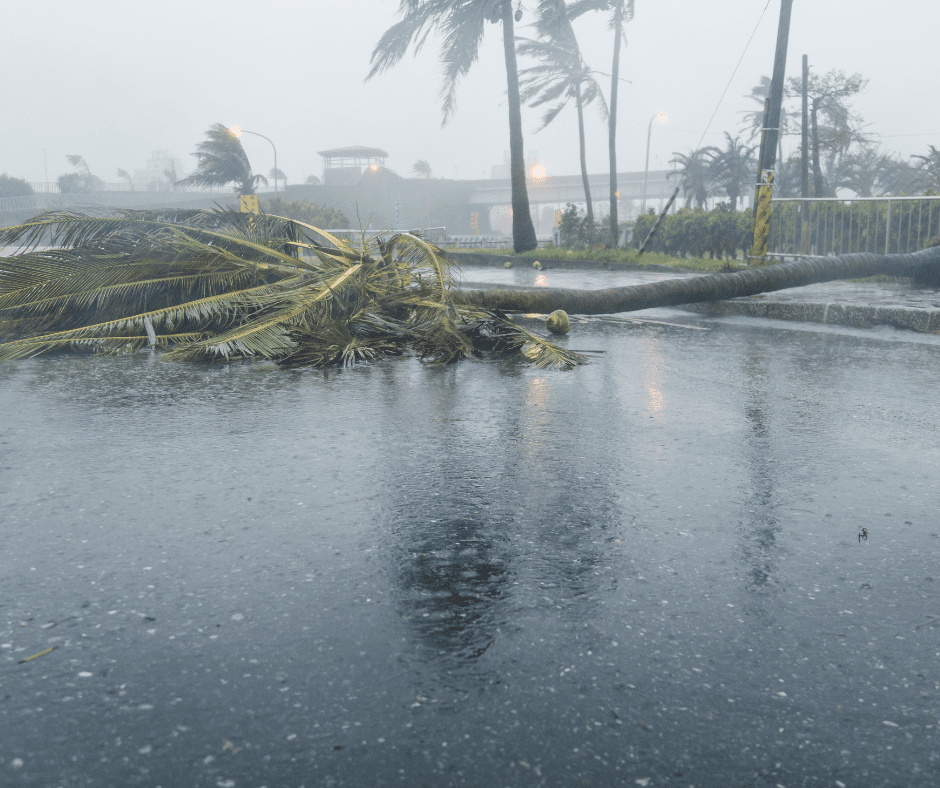

In the face of increasing reports of climate change-related catastrophes, including floods, a recent survey commissioned by Selective and conducted…

As the weather warms up and the flowers start to bloom, many of us feel the urge to tackle some…

As we enter a new year, homeowners may be wondering about the future of home insurance prices in 2024. The…

Winter is just around the corner, and it’s time to prepare our homes for the colder months ahead. Here’s a…

Nationwide has announced that they are assessing the damage from the recent severe weather that impacted the eastern part of…

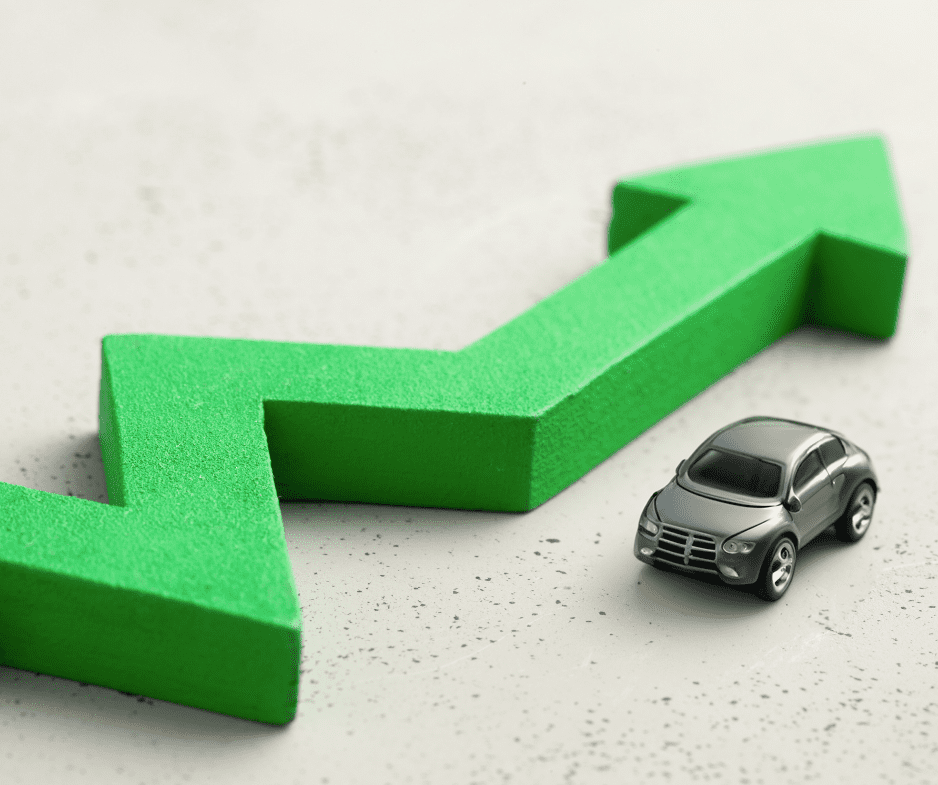

According to a recent report by Bankrate, car insurance rates have surged, with yearly premiums up more than 240% on…

It is that time of year when everyone keeps an eye on their calendars. Whether it is the beach, the…

State Farm, the largest home insurer in California, has announced that it will no longer write new home and business…

Hurricane season is almost here and people living in coastal areas need to be prepared for the possibility of a…